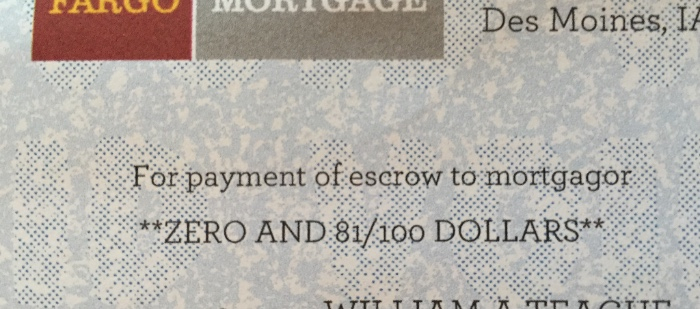

About that eighty-one cent check.

Each month we pay our mortgage company the agreed-upon interest and principal on our home loan plus some extra they put into an escrow account to pay our property taxes when they come due. Many if not most of us do the same.

Once a year the mortgage company recalculates the amount to be withheld for the escrow account to be sure there is not too little and not too much in the reserve when it comes time to pay the taxes. In our case the readjustment is typically small, sometimes a little up and sometimes a little down.

It turns out that there is a law, probably a good law, which forbids the mortgage company, in our case one of those too-big-to-fail banks, from withholding too much money; over withholding to their advantage and our disadvantage. From what I can tell, the law allows only small margin of error for the banks when they calculate the monthly escrow amount. They really should not have more of our money than they reasonably need. That’s why we received the check for **ZERO AND 81/100 DOLLARS**.

During the past twelve months too-big-to-fail had taken from us **ZERO AND 81/100 DOLLARS** more than they should have taken. In compliance with federal law, they have returned all eighty-one cents to its rightful owner.

I need to take that check for **ZERO AND 81/100 DOLLARS** to our small-enough-to-fail bank and deposit it in our account. Or maybe I will just take the pennies. Cashed or deposited, we’re getting our eighty-one cents back from too-big-to-fail.

Someone could do the math. Someone could figure out what it costs too-big-to-fail to refund our **ZERO AND 81/100 DOLLARS**. Postage, paper, sophisticated computer system that processes eighty-one cent checks without a human hand or eye ever involved. And our small-enough-to-fail bank will spend some money getting the eighty-one cents into or account or those eighty-one pennies into my pocket.

It is going to cost a lot more than eighty-one cents to protect us from the overreach of too-big-to-fail. And that is the way it should be.

The Reformers called it the Second Use of the Law. As they considered the Ten Commandments and their practical explication in the pages of Scripture, they argued that the Law, especially the Second Tablet with its “shall not’s” was a gift to humankind not just to reveal our need for a savior, one who is able fulfill the law as we never can, but also as a gift for the organizing of all human society in a way that protects especially the vulnerable and the kind from the strong and those who tend to overreach and think of themselves as too big to fail. Not killing, not stealing, not lying, not committing adultery, not coveting are important beyond the walls of the church or the synagogue.

The federal law that forbids too-big-to-fail from keeping even eighty-one cents more than it should is one of the second uses of the law that prohibits stealing.

God knew that as soon as Adam and Eve were expelled from the garden, they and their descendants would start living lives where those who think of themselves as too big to fail take advantage of those considered too small to be of much account. They’d steal and murder and lie and covet and cheat on their spouses for their own selfish ends.

The Law and all the laws derived from it are a gift from God. They protect the innocent and limit the powerful in the ungodly use of their power. The Law and all good laws are a common grace, the theologians tell us.

I scoffed when that check for **ZERO AND 81/100 DOLLARS** found its way into our mailbox. I thought about not cashing it at all. Why the waste of time? Then I thought about cashing it just to be sure too-big-to-fail didn’t end up with my eighty-one cents as part of its ill-begotten gain. But now when I cash it, I will thank God for this small reminder of common grace.

I think the eighty-one cents is going to go in the Pennies, Nickels, Dimes jug to help a Guatemalan child go to school. In God’s economy even **ZERO AND 81/100 DOLLARS** is put to good use.

See you Sunday